Investment Banking - Canaccord Genuity

A Biased View of FOCUS Investment Banking

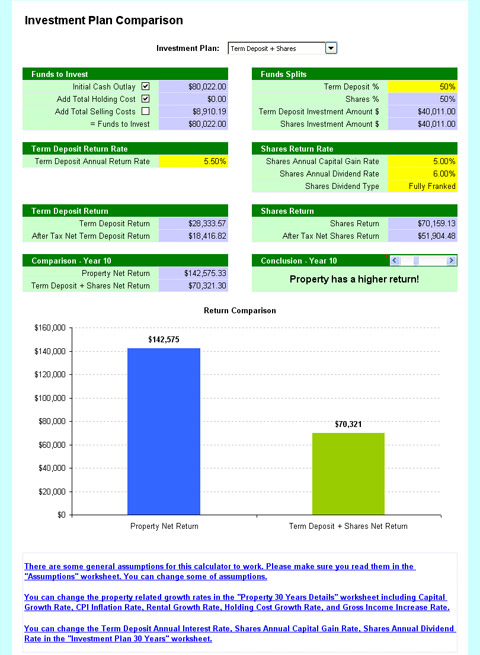

Often, when a business holds its preliminary public offering (IPO), a financial investment bank will buy all or much of that business's shares straight from the business. Consequently, as a proxy for the business holding the IPO, the financial investment bank will offer the shares on the marketplace. Click Here For Additional Info makes things a lot easier for the company itself, as they efficiently agreement out the IPO to the investment bank.

In doing so, it also takes on a considerable amount of risk. Though knowledgeable experts use their expertise to accurately price the stock as finest they can, the financial investment bank can lose money on the deal if it turns out it has actually miscalculated the stock, as in this case, it will often need to offer the stock for less than it at first spent for it.

Investment Banking Process - Due Dilligence

Pete, the owner, gets in touch with Jose, a financial investment lender working for a bigger financial investment banking firm. Pete and Jose strike an offer wherein Jose (on behalf of his company) consents to buy 100,000 shares of Pete's Paints for the business's IPO at the price of $24 per share, a rate at which the investment bank's experts got here after mindful consideration.

Some Known Facts About Investment Banking Courses From BIWS - Join 48K Members.

4 million for the 100,000 shares and, after filing the appropriate paperwork, begins offering the stock for $26 per share. Yet, the financial investment bank is not able to sell more than 20% of the shares at this rate and is forced to reduce the rate to $23 per share in order to sell the staying shares.

Making Sense of the Innovation in Investment Banking - Fintech Insights

36 million [( 20,000 x $26) + (80,000 x $23) = $520,000 + $1,840,000 = $2,360,000] In other words, Jose's firm has actually lost $40,000 on the offer due to the fact that it miscalculated Pete's Paints. Investment banks will frequently take on one another for securing IPO tasks, which can require them to increase the rate they want to pay to protect the handle the company that is going public.